Overview

Payouts

Send mass payments to individuals and businesses quickly and compliantly

with the Payouts solution. Purpose-built for Enterprises and

Marketplaces to send payout disbursements in Southeast Asia (Europe and

Turkey coming soon), Payouts helps streamline the payout process and

ensure an intuitive, frictionless experience for your recipients. This

documentation is broken into distinct sections:

-

Introduction

- Learn how the

Payoutssolution is architected and the customer types that will benefit from implementing this type of disbursement product. Includes a deep dive on the supported Payout Models.

- Learn how the

-

Components

- Review definitions for important Components of the

Payoutssolution, as well as how they are used. This includes uP IDs, overviews of available transfer types and methods, details on how to fund your payouts and an explanation of thePayoutssolution’s standard reports.

- Review definitions for important Components of the

-

SFTP

- Understand how to setup your SFTP access and how your SFTP directories will be configured (this will be dependent on your chosen integration method).

-

Integration Ecommerce API

- Review important information outlining how to enable the

Payoutssolution using the Payments - Ecommerce API integration method. The Payments - Ecommerce API is the preferred integration method for the

Payoutssolution.

- Review important information outlining how to enable the

-

Payments - Ecommerce API Payout Reference

- This is where you will find detailed technical documentation for the Payments - Ecommerce API integration method.

-

Payments - Ecommerce API Webhooks

- Understand how webhooks can help increase visibility into your payment statuses.

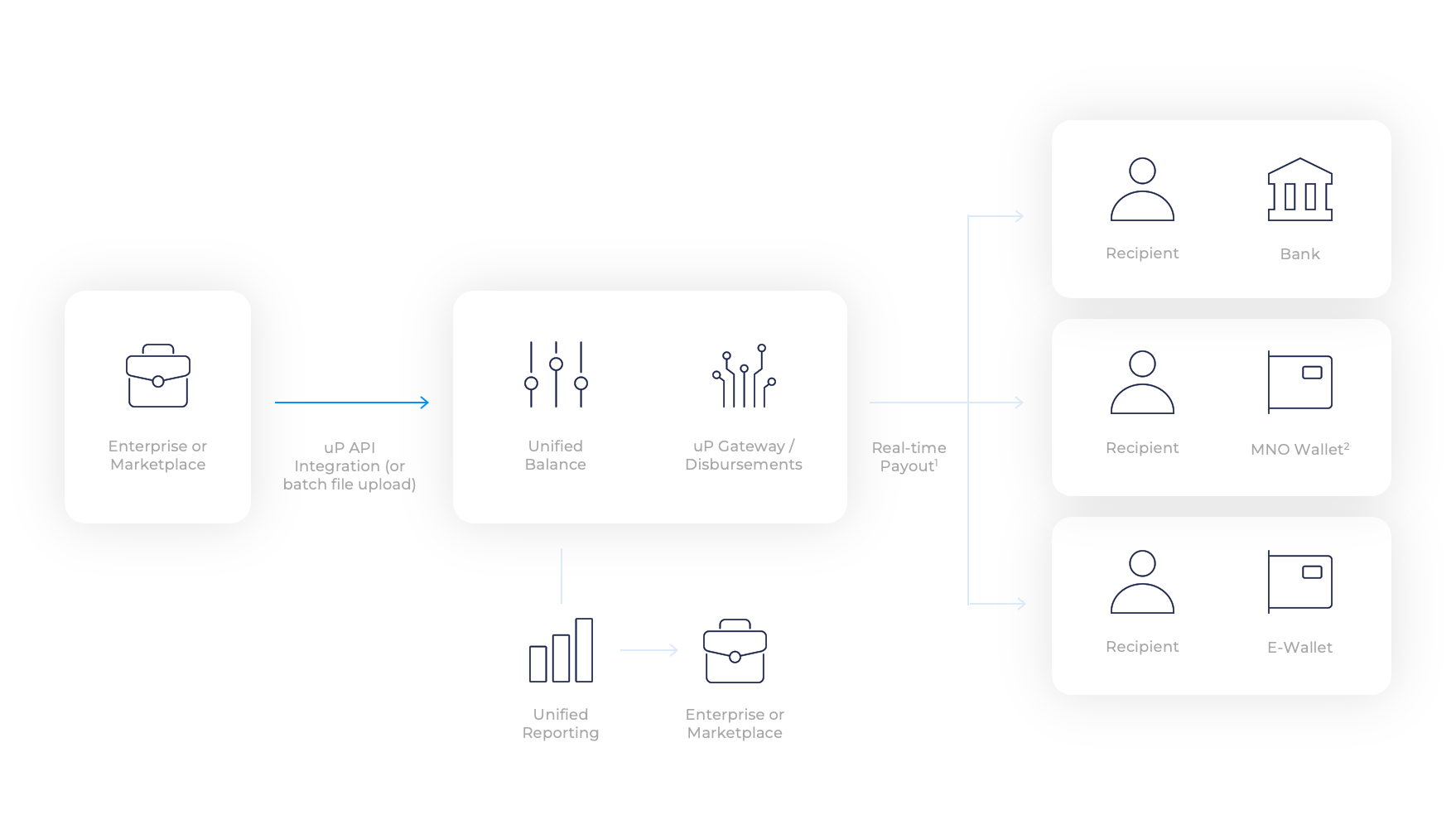

Solution architecture

The Payouts solution is a standalone disbursement solution. It is built

on a Good Funds Model which means that your organisation will be required

to send funds to Nomupay prior to making payments to your recipients. These

funds will be deposited into a dedicated For Benefit Of (or FBO) Funding

Account. This FBO account allows Nomupay to safely and securely manage

funds on your behalf.

Funds that are deposited into your Funding Account are shown within your

Unified Balance. The heart of the Nomupay Platform, the Unified Balance is

composed of 3 sub-balance types: the Pending Balance, the Available

Balance, and the Reserve Balance. In the Payouts solution, funds that

are deposited into your Funding Account will be visible in the Available

Balance and thus can be used for payout activities.

When you’re ready to send mass payments to your recipients, simply provide Nomupay with the required payment instructions uP API, and the uP Platform will debit funds from your Unified Balance (removing them from your Available Balance) and, depending on the Payout Model that you’ve selected, either transfer them directly to your recipients’ previously onboarded transfer method, or send them to your recipients’ uP Wallets where the recipient will have the ability to initiate a transfer to an onboarded transfer method (see Payout Model section for more details).

As the owner of the Unified Balance, you can, at any time, withdraw any available funds and send them into your designated bank account.

Customer types

The Payouts solution can be architected to handle 2 customer types and

their corresponding use cases:

-

Enterprises and Marketplaces: Large organisations that have their own in-house payment infrastructure and are eager to technically integrate with the Nomupay Platform to improve their fee, reward, commission or claims payout disbursement capabilities.

-

Referral Clients: Customers that have a network of potential Enterprises and Marketplaces that they wish to refer to Nomupay. Referral Clients do not technically integrate with the Nomupay Platform themselves, rather, they assist the Nomupay team with relationship management and solutioning the proper

Payoutssolution. This could include consultants, industry associations, etc.

The remainder of the Payouts solution documentation will focus on

aspects of the technical integration for the first customer type

(Enterprises/Marketplaces). If you are interested in becoming a Nomupay

Referral Client for our Payouts solution, please contact our

solutioning

team

directly for more information specific to this use case.