Solution architecture

The uP Payments solution is a standalone payment acceptance product that is designed to work seamlessly with your existing payment systems, providing fast access to payment acquiring in countries throughout Southeast Asia, Turkey and Europe. With modern integrations for both in-store and e-commerce models, the uP Payments solution utilises the uP Platform's powerful data normalisation reporting technology to provide a truly omnichannel understanding of card and alternative payment method (APM) transactions occurring within your omnichannel commerce ecosystem.

Customer types

The uP Payments solution can be architected to handle 3 customer types and their corresponding use cases:

Reseller clients

Customers that are eager to technically integrate with the uP Platform and resell NomuPay's local card and APM acquiring capabilities to their existing merchant base. This could include payment service providers, merchant gateways, independent sales organisations (ISO), as well as a variety of others. See the payment models section for more information on requirements for integrating with the uP Platform for the purpose of reselling NomuPay's acceptance capabilities.

Enterprises and marketplaces

Large organisations that have their own in-house payment infrastructure and are eager to technically integrate with the uP Platform to improve their payment acceptance capabilities. See the payment models section for more information on the technical requirements necessary to integrate directly with the uP Platform's acceptance capabilities.

Referral clients

Customers that have a network of potential reseller clients and/or enterprises and marketplaces that they wish to refer to NomuPay. Referral clients do not technically integrate with the uP Platform themselves, rather, they assist the NomuPay team with relationship management and solutioning the proper uP Payments solution. This could include consultants, industry associations, etc.

The remainder of the uP Payments solution documentation will focus on aspects of the technical integration for the first 2 customer types (reseller clients and enterprises/marketplaces). If you are interested in becoming a NomuPay referral client for our uP Payments solution, please contact our solutioning team directly for more information specific to this use case.

The uP Payments solution requires reseller clients, enterprises and marketplaces to integrate with the uP Platform. The type of integration required will be dependent on the payment model(s) that you wish to configure. See the payment models section for more information.

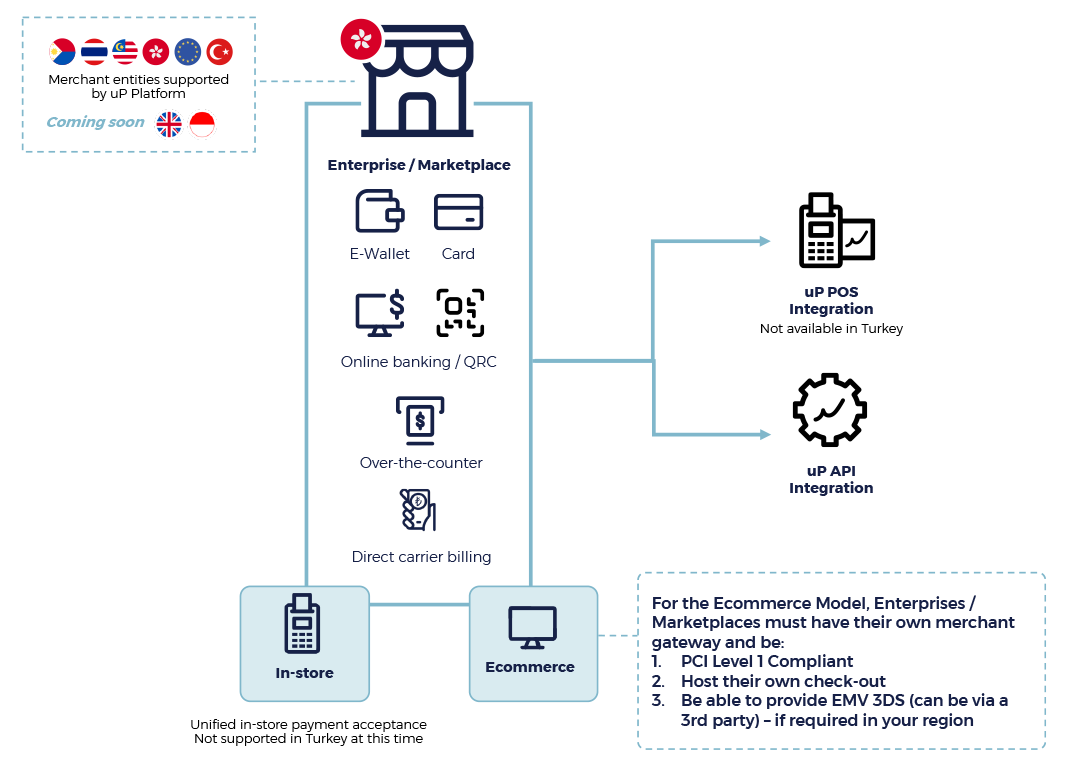

The uP Payments solution can be configured for enterprises and marketplaces with entities in one or more of the following countries or regions: Europe, Turkey*, Hong Kong, Malaysia, the Philippines and Thailand.

*TURKEY AVAILABILITY: The uP Payments solution is intended for expansion-minded, multi-entity enterprises and marketplaces (i.e., organisations that have an entity in Turkey, as well as in another uP Platform-supported country or region: Europe, Hong Kong, Malaysia, the Philippines and/or Thailand). Enterprises and marketplaces that are looking for a domestic-only payments acceptance solution in Turkey also have the option of integrating directly to NomuPay's Turkey Payments Platform. Not sure which route is right for you your business? Don't worry; the NomuPay solutioning team will help you decide which integration is best for your business use case.

See the diagram below for a high-level visualisation of the uP Payments integrations and entity requirements for enterprises and marketplaces.

Enterprise and marketplace solution architecture: Integrations and entity requirements diagram

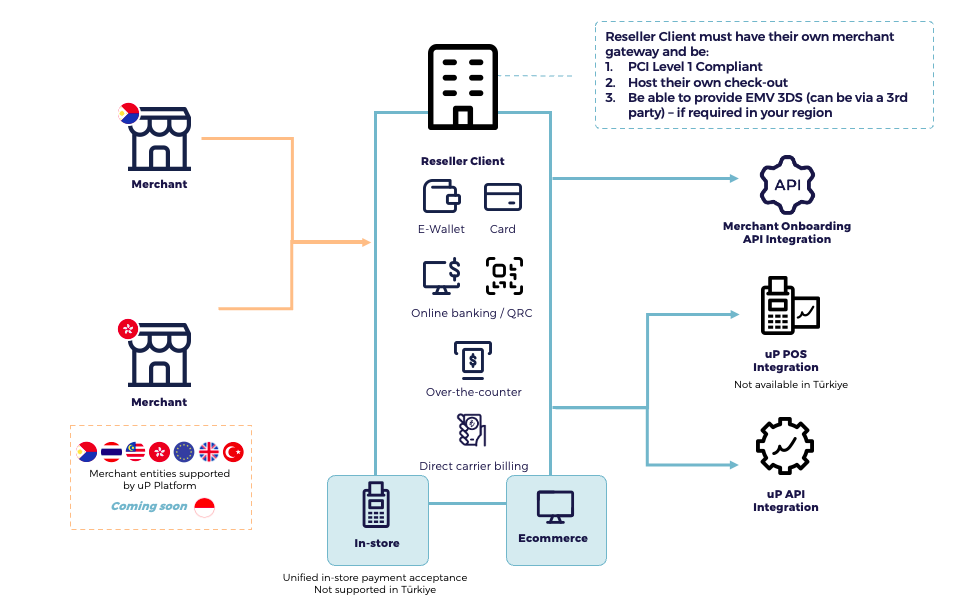

Reseller clients do not have to abide by any specific entity requirements, however the merchants that they onboard to the uP Platform must have an entity in one or more of the following countries: Europe, Turkey, Hong Kong, Malaysia, the Philippines and Thailand. Additionally, reseller clients will be required to integrate with NomuPay's merchant onboarding API. Purpose-built for reseller clients, the merchant onboarding API enables the fast, efficient and secure submission of merchant data and documentation to the uP Platform Onboarding System (uP POM). Reseller clients can onboard merchants with entities in Europe, Turkey, Hong Kong, Malaysia, the Philippines and Thailand to the uP Platform via the merchant onboarding API. View the merchant of reseller client onboarding section for more details. See the diagram below for a high-level visualisation of the uP Payments integration and entity requirements for reseller clients.

Reseller client solution architecture: Integrations and merchant entity requirements diagram

Once integrated to the uP Platform, enterprises, marketplaces and merchants of reseller clients will have access to a growing catalogue of local payment methods. Transactions that are processed by the uP Platform will settle with NomuPay before being funded into an enterprise's or marketplace's Unified Balance, or, in the case of reseller clients, one or more of their onboarded merchants' Unified Balances. Funds that have been deposited into a Unified Balance are then automatically sent to an associated bank account. See the Funding section for more information on this process.

The standard reseller client uP Payments solution architecture removes resellers from the funding flow (i.e., NomuPay funds merchants of reseller directly). If you are a reseller client that is interested in a solution that enables you to remain in the flow of funds, please contact NomuPay's solutioning team directly with details of your use case.

The uP Payments solution utilises the uP Platform's data normalisation technology to provide reseller clients, enterprises and marketplaces with streamlined reporting information. NomuPay offers reseller clients, enterprises and marketplaces 2 standard reports as part of the uP Payments solution. See the Reporting section for more details on available reports and reporting data. In addition to these 2 standard reports, reseller clients are also provided with Rev Share / Buy Rate data.

As a standard offering, NomuPay does not provide reports or reporting data directly to merchants of reseller clients. NomuPay provides reporting data to the reseller client only (either via SFTP or API); the reseller client is then responsible for sharing this data with their merchants.