Funding

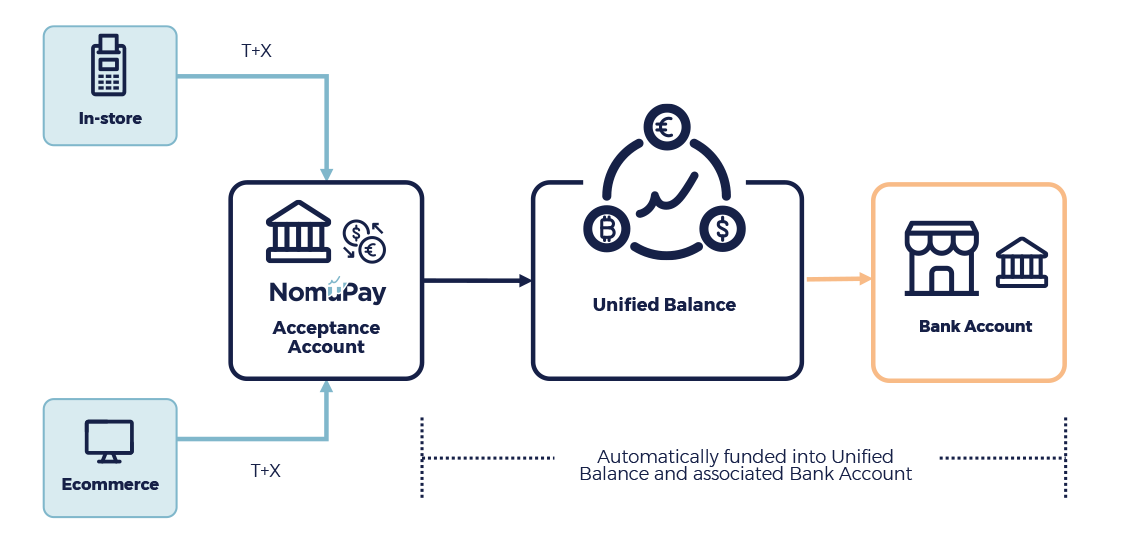

Funds from transactions that are successfully completed via the uP Platform are settled to NomuPay's Acceptance Account with a T+X timeframe. For example, if a transaction is successfully completed on Wednesday, NomuPay will receive settlement of the funds for this transaction X business days following the successful transaction date.

The number of business days (i.e., "X") is dependent on multiple factors, including the payment method, country where the transaction took place, etc. The NomuPay team will provide you with a more exact understanding of settlement timelines during the onboarding process. Once funds are settled to NomuPay, they are automatically funded into an enterprise's, marketplace's or merchant of a reseller client's Unified Balance (minus any fees and/or deducted taxes).

In the uP Payments solution, funds that are sent to a Unified Balance are automatically withdrawn to an associated bank account. enterprises and marketplaces are required to provide this bank account information as part of the enterprise or marketplace onboarding process. Reseller clients are required to provide bank account details for their merchants via the Banking details entity within the merchant onboarding API.

Funding currencies

NomuPay's standard funding configuration is local currency only and to a single associated bank account per legal entity country. This is the standard for enterprises and marketplaces as well as merchants of reseller clients. Multi-currency funding is available on a case-by-case basis and is dependent on a number of requirements. Please discuss this with your NomuPay onboarding specialist to learn more.