Funding

The uP Payouts solution is built on a Good Funds Model which means that your organisation will be required to deposit funds to NomuPay via a designated bank account prior to sending disbursements to your recipients. Funds will be deposited into a dedicated For Benefit Of (or FBO) Funding Account.

NomuPay is required to approve and provision a Funding Account to your uP Account ID. A NomuPay representative will provide you with additional details on this process during your onboarding process.

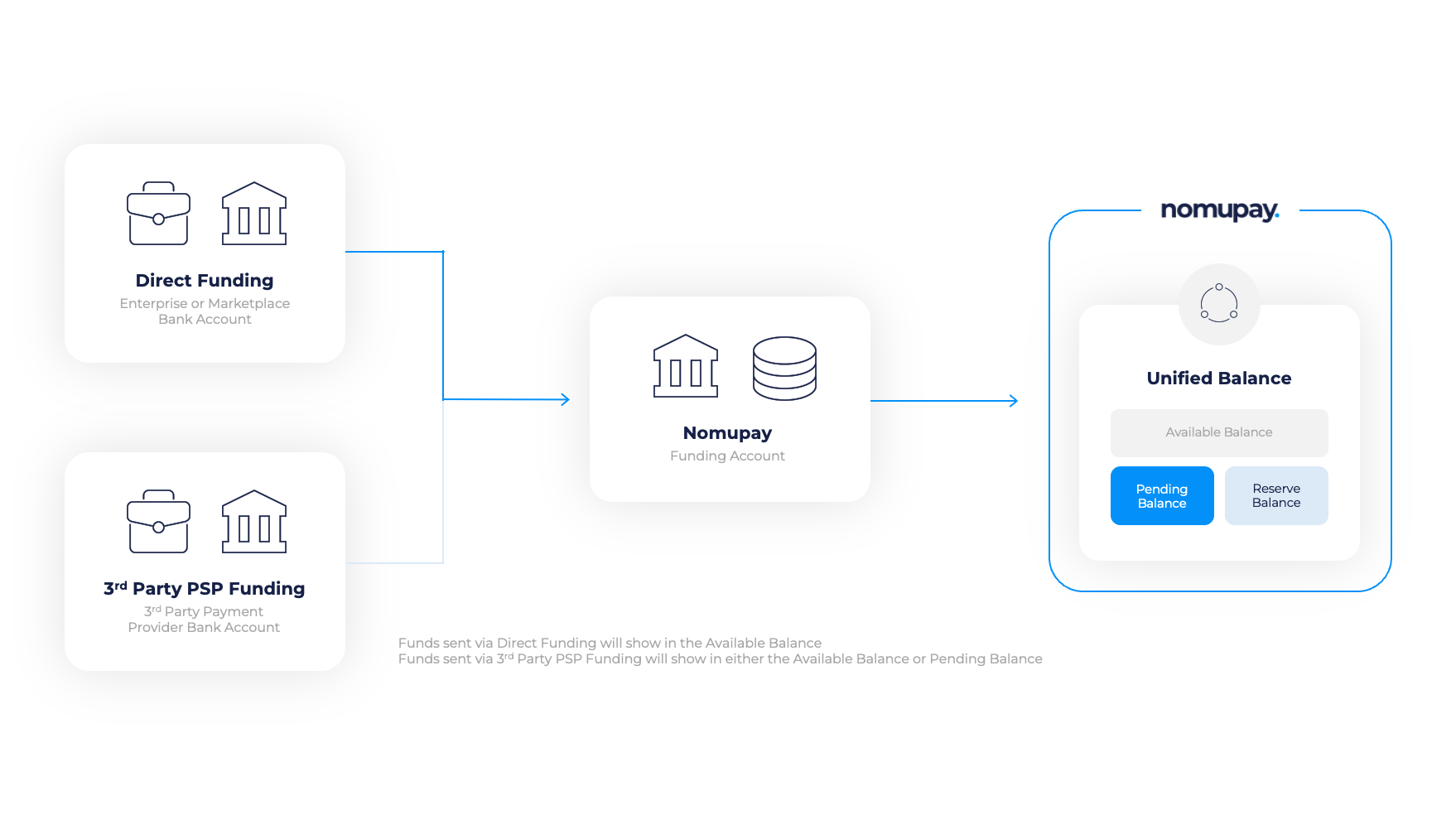

You can deposit funds to your Funding Account based on the needs of your business. In most standard payout use cases, you will use the Direct Funding model, whereby funds are sent from your bank account directly to your NomuPay Funding Account. Funds that are sent via the Direct Funding model are deposited into your dedicated Funding Account are visible within the Available Balance portion of your Unified Balance. In some use cases, however, you may also wish to send funds to your NomuPay Funding Account via a 3rd Party Payment Service Provider. In these cases, NomuPay will need to review and approve the account before funds are deposited to your Available Balance. Furthermore, additional integration effort will be required by the 3rd Party Payment Provider.

Funds deposited to your FBO account will not be reflected in your Unified Balance. This process can take up to 3-days and depends on how you transfer funds to NomuPay (ex. wire transfer).

The Unified Balance is the centralised hub of your uP Payouts solution. The Unified Balance is composed of 3 types: the Pending Balance, the Available Balance, and the Reserve Balance. In the uP Payouts solution, funds that you deposit into your Funding Account will be represented in the Available Balances. This means that they are available to be used for disbursements.